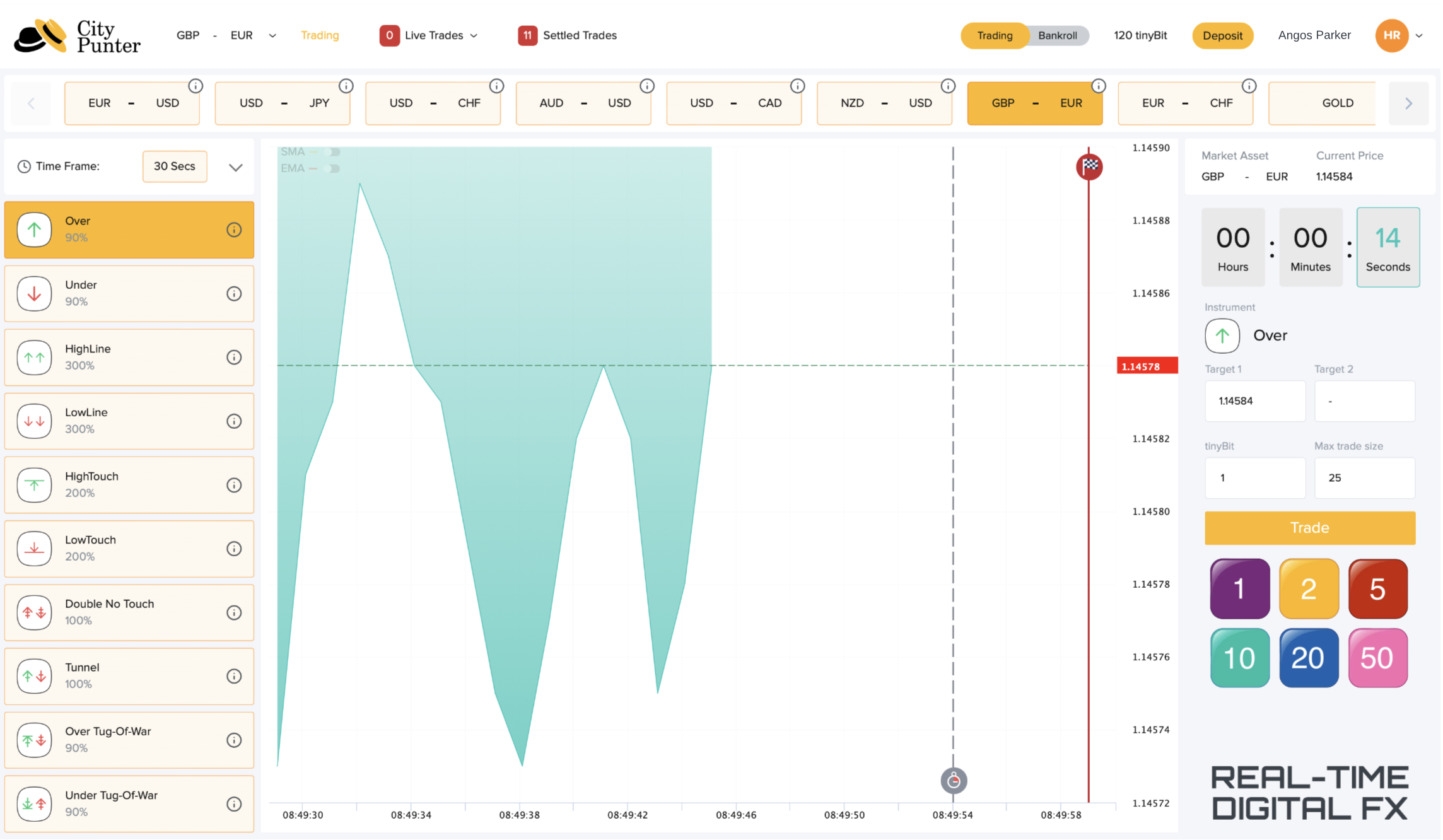

Over

- The 'Over' (with the 'Under) is the most basic way of trading on the future direction of an FX price.

- They are not complex strategies hence their huge popularity.

- The Target 1 price is always the current FX price so if one were to buy the 'Over' then the FX price at expiry has to be higher than the FX price when you entered the trade.

- N.B. Latency: In this instance the current GBP-EUR price is 1.14584 as shown in the top right-hand corner of the Trading page. This price is repeated in the Order Ticket under Target 1. They are indicative prices and latency means that the Target 1 price you see may not be the Target price you get. There is a 50:50 chance the target price will be higher or lower than the Target 1 price in the Order Ticket.

- The red-backed price on the right-hand scale shows 1.14578. Graphics latency means this price is maybe 0.2 of a second 'late'. The price charts are there as a graphic representation of historical prices, not prices to trade off.

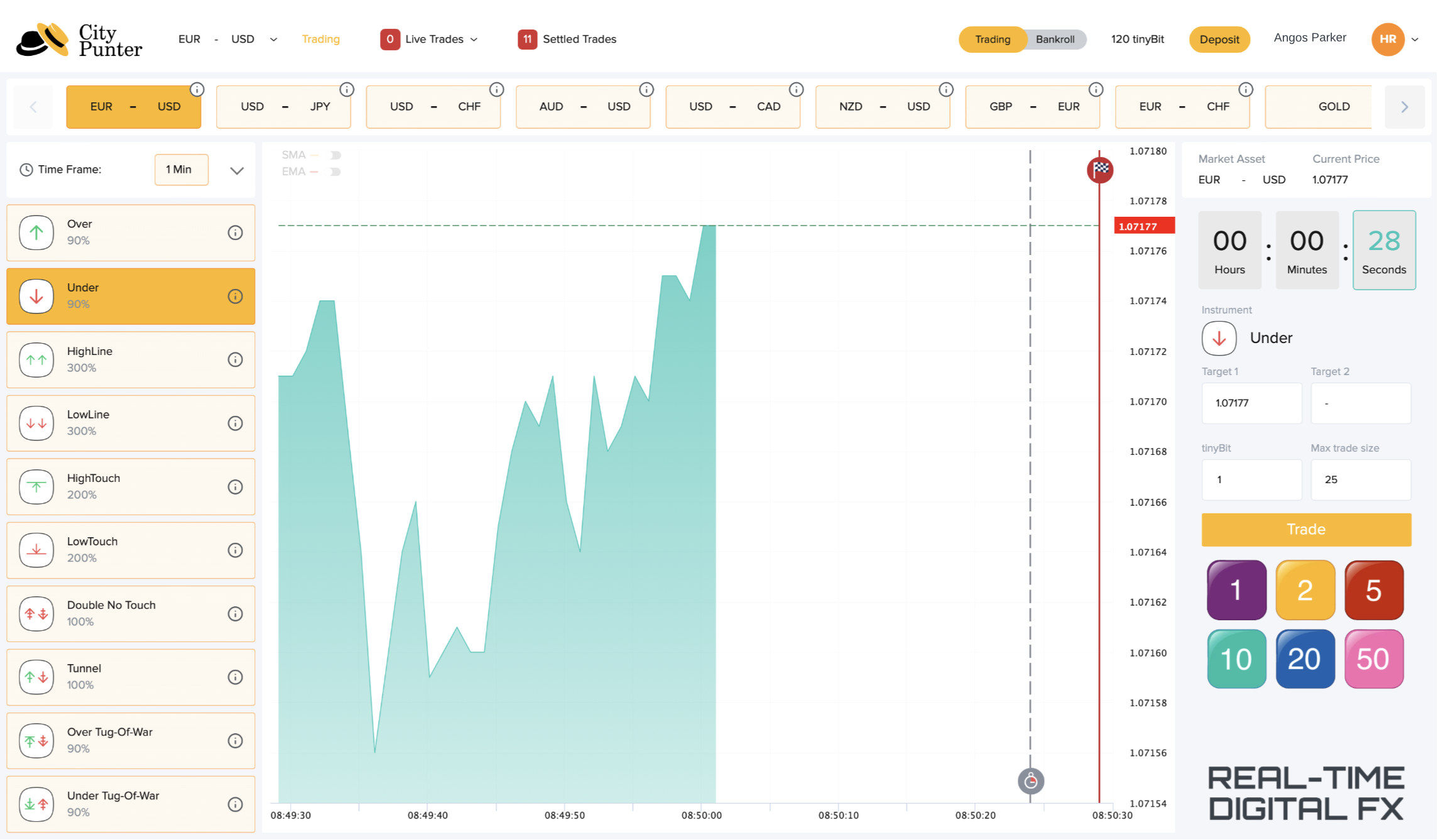

Under

- ‘Under’ – the opposite of the ‘Over’.

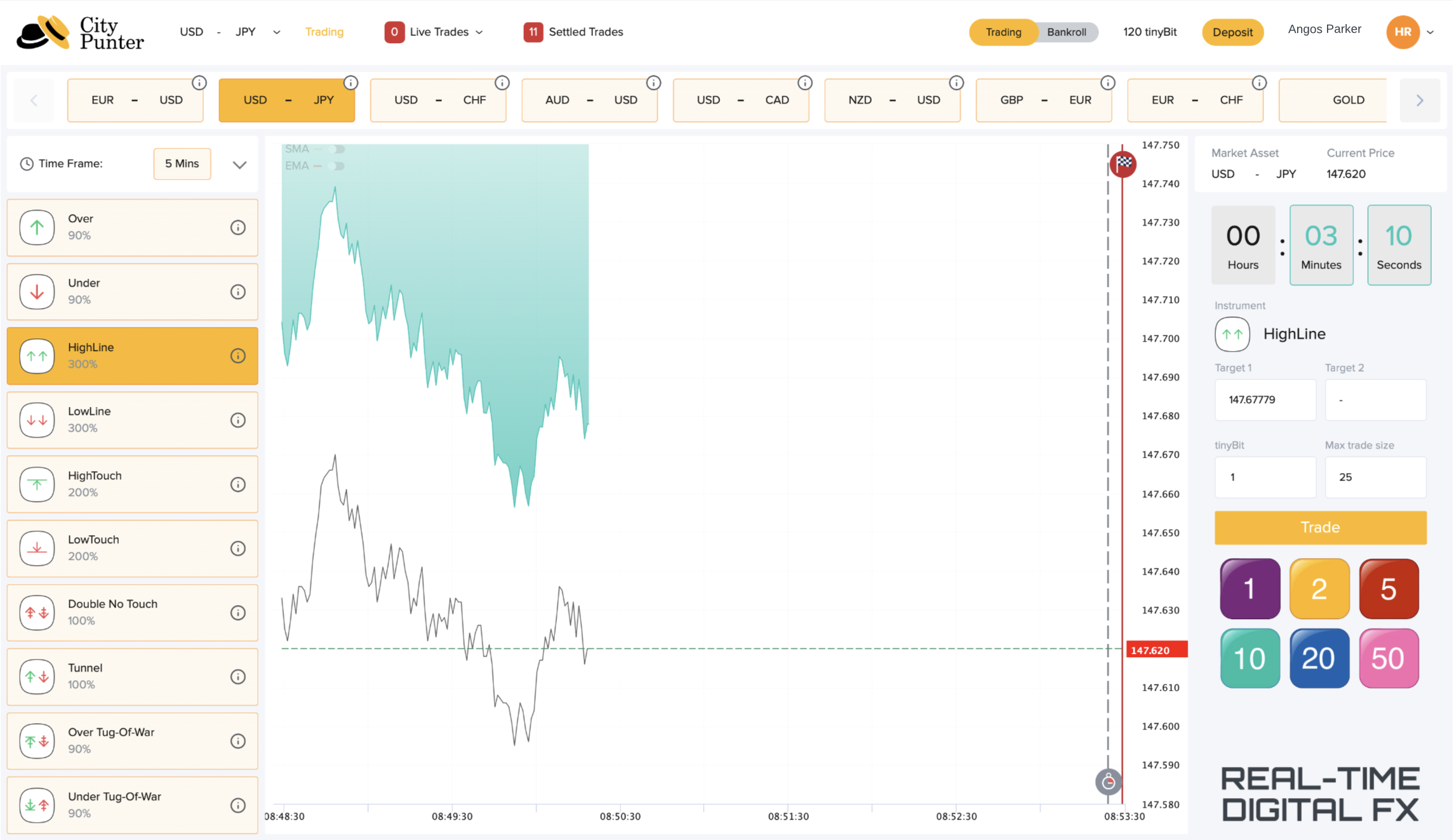

HighLine

- The HighLine presents a target price ABOVE the current FX price. In the adjacent screenshot USD-JPY price is 147.620 and the Target 1 price is 147.67779.

- The term of the trade is 5 minutes (top left) of which there are 3m 10s (top right) remaining.

- Since there is a lower probability (compared to the Over) that the trader will win the trader is offered a higher return.

- The return on offer to the trader is 300%.

- The gap between the FX price and the Target 1 price narrows over time so you will notice the latest FX price on the right is much closer to the target (blue shaded area) than the FX price on the far left. This is to keep a constant probability of the trader winning, hence constant payoff of 300%.

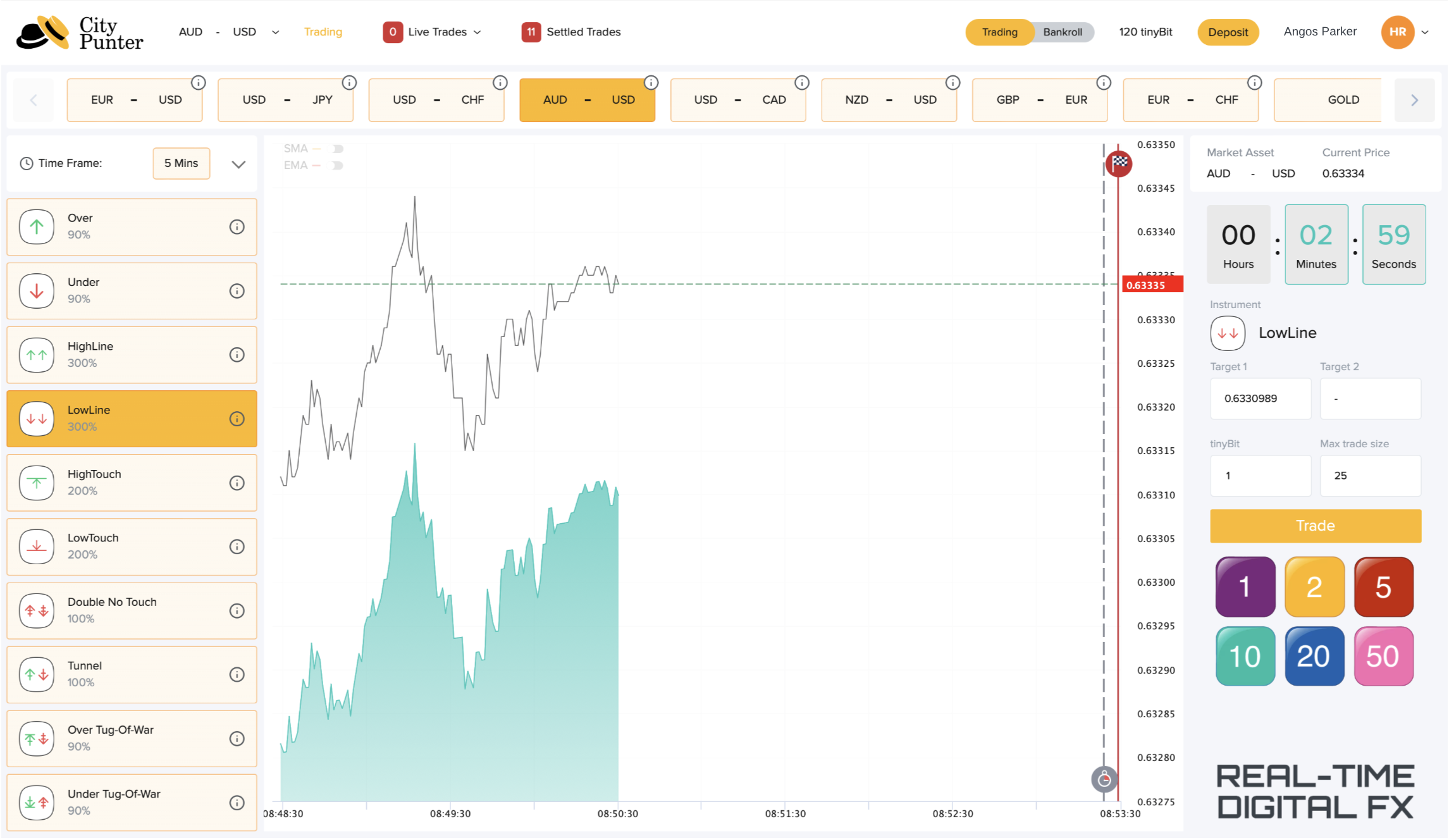

LowLine

- The opposite of the HighLine

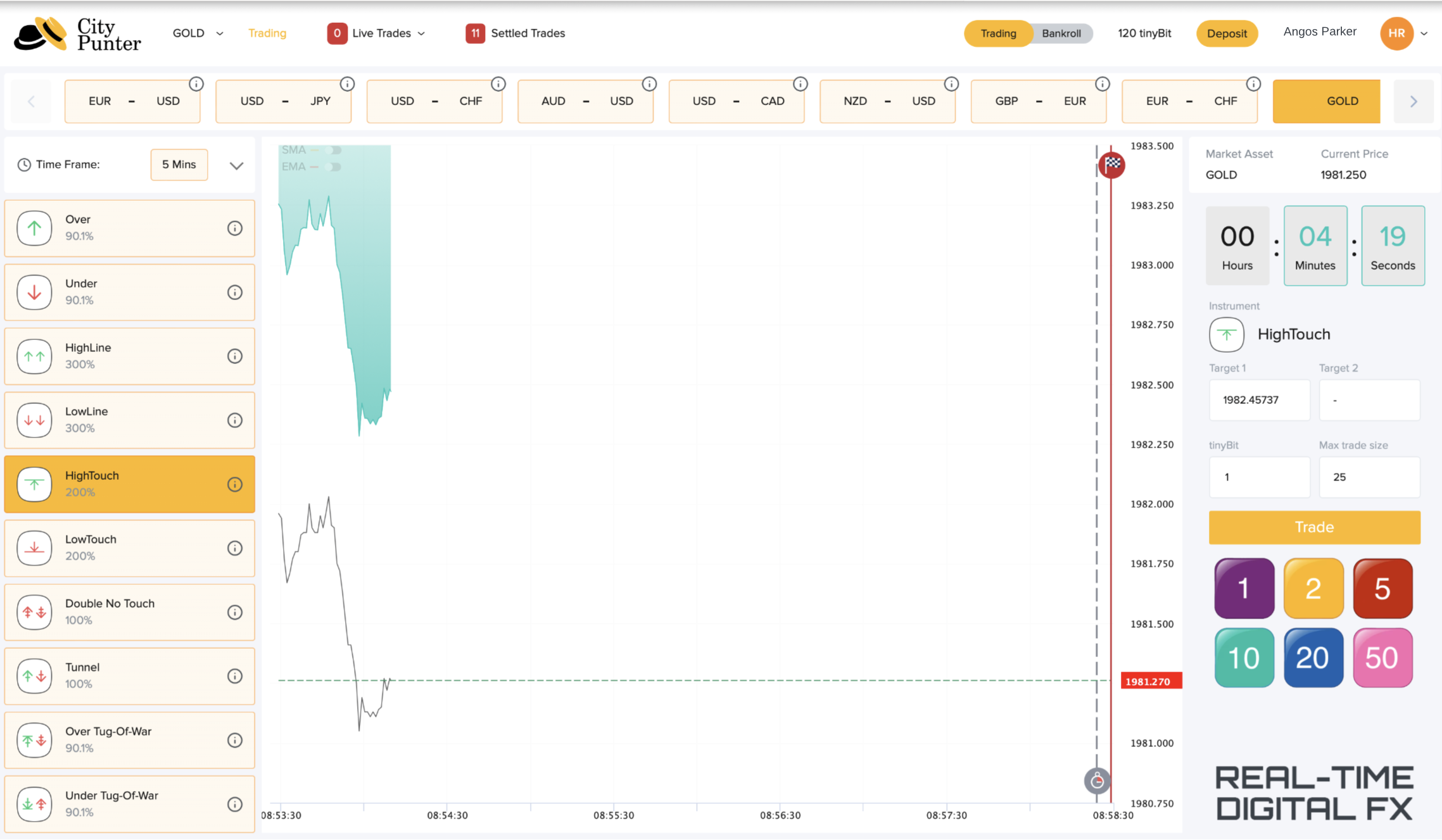

HighTouch

- The HighTouch presents a target price ABOVE the current FX price. In this case the Gold price must touch or 'be above the Target 1 level at any time prior to the end of the trade for the trader to win.

- In the adjacent screenshot the Gold price is 1981.250 and the target price is 1982.45737.

- The term of the trade is just 5 minutes (top left) of which there are 4m 19s (top right) remaining.

- The trader is offered a return of 200% (3x).

- The gap between the Gold price and the Target 1 level narrows over time so that the latest Gold price on the right is closer to the Target 1 level than the price on the far left. This is to keep the chances of the trader winning constant which in turn means there is no advantage or disadvantage gained or lost by trading early or late.

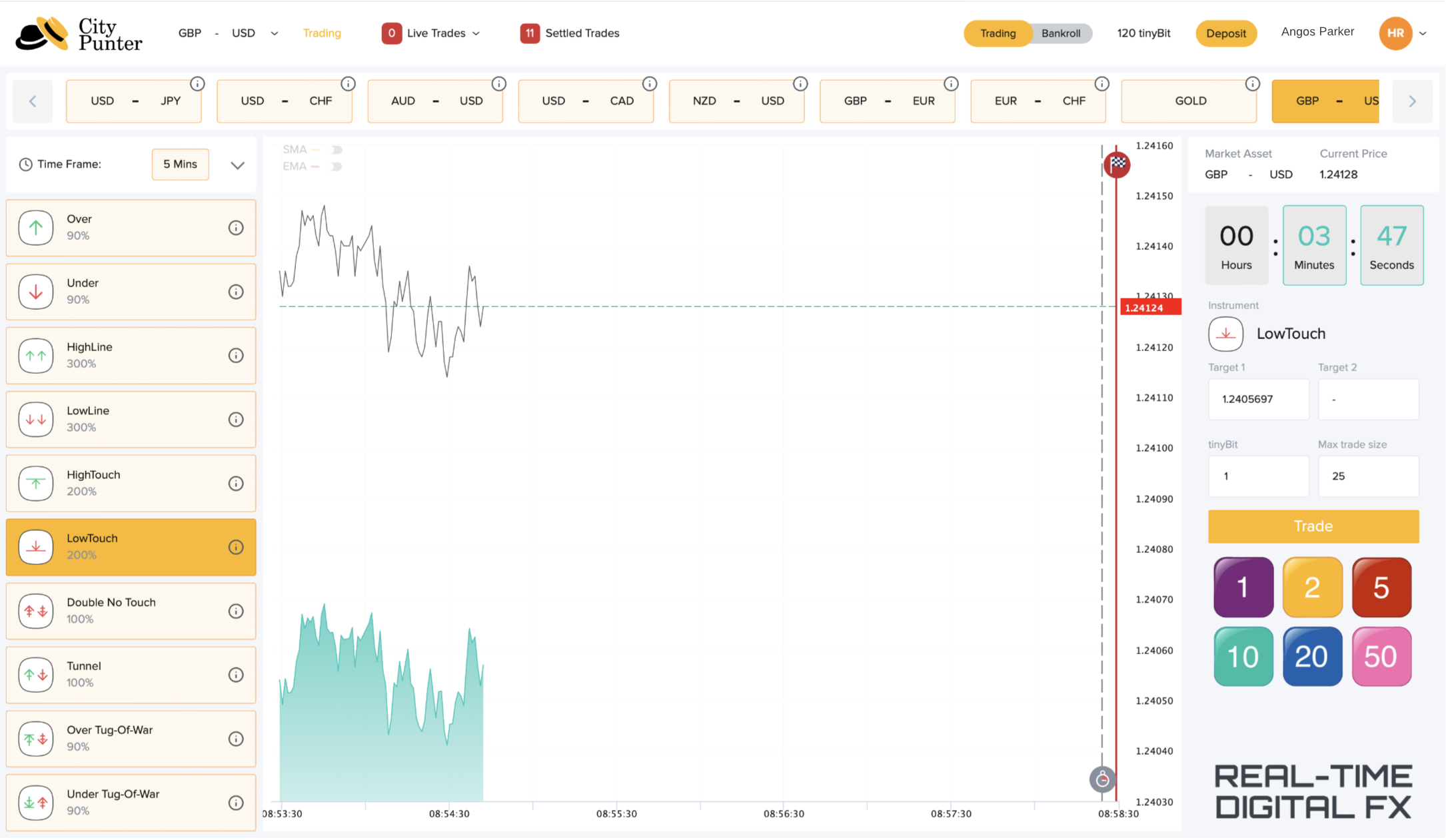

LowTouch

- The opposite of the HighTouch

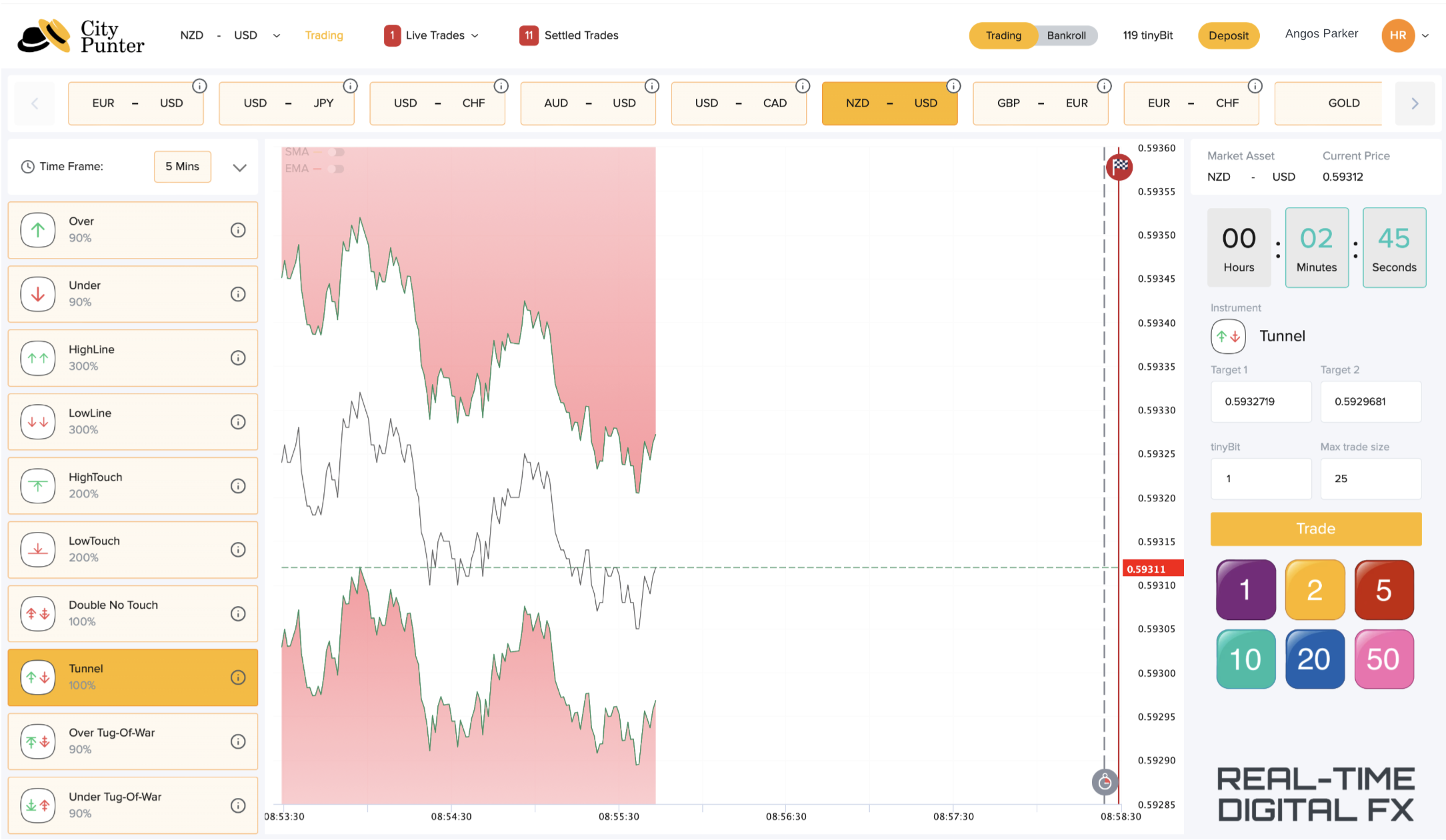

Tunnel

- The Tunnel presents two target prices, one ABOVE and one BELOW the current FX price between which the FX price must be at the end of the trade.

- In the adjacent screenshot the NZD-USD price is 0.59312 with target levels of 0.5932719 and 0.5929681.

- The term of the trade is 5 minutes (top left) of which there are 2 mins 45 secs (top right) remaining.

- The trader is always offered a return of 100% (2x).

- The gap between the two target levels narrows over time so the target level's gap on the left is far wider than the gap on the right. This is to keep the chances of the trader winning constant.

- The target levels are delineated in green to show the FX price can venture into the red area prior to the trade's end, although the price MUST be between the target levels at expiry of the trade.

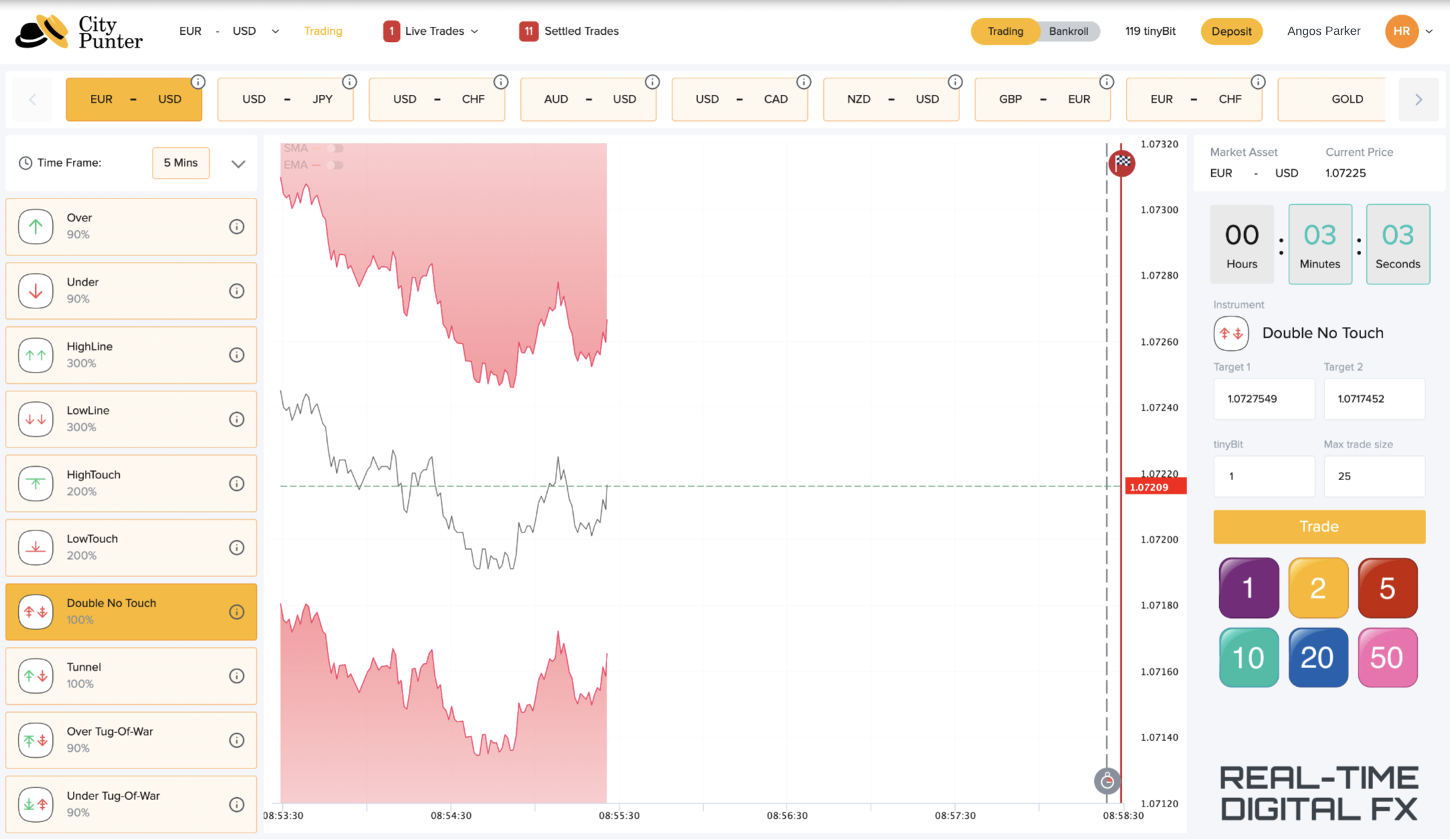

Double No-Touch

- The Double No-Touch also presents two target levels, one ABOVE and one BELOW the current FX price. In this case the EUR-USD price must always remain between the target levels right up until the end of the trade otherwise the the trader immediately gets KO'd.. So, unlike the Tunnel, the FX price cannot encroach into the red area prior to the end of the trade.

- In the adjacent screenshot the EUR-USD price is 1.07225 with target levels of 1.0727549 and 1.0717452. The term of the trade is 5 minutes (top left) of which there are 3 mins 03 secs (top right) remaining.

- The trader is always offered a return of 100% (2x).

- The target levels are delineated in red to show, with this strategy, the FX price cannot touch either the red line or red area otherwise the trade is immediately KO'd.

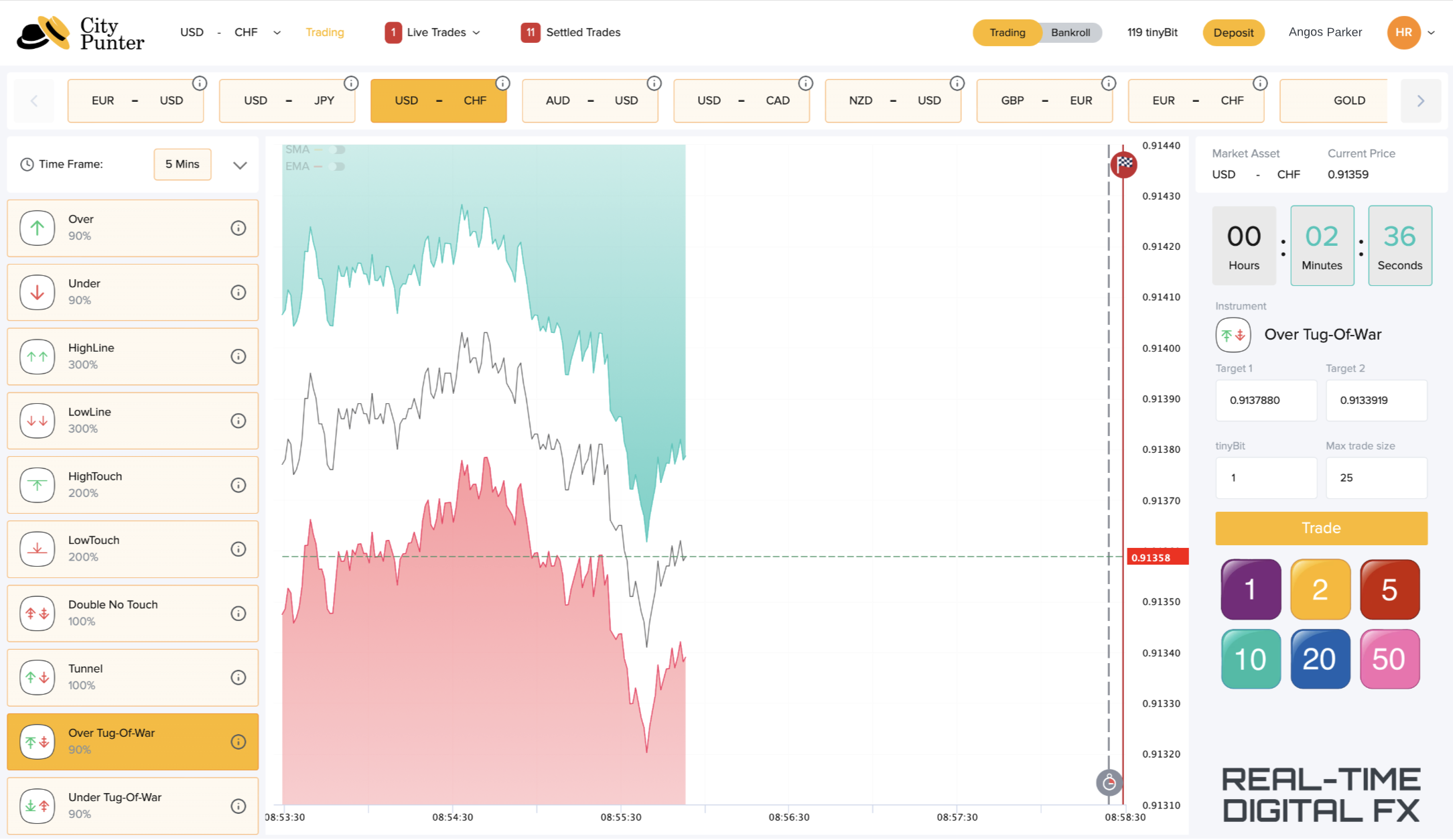

Over Tug-of-War

- The Over Tug-of-War presents a target level ABOVE and BELOW the current FX price. If the FX price hits the upper target level then the trader immediately wins. If the FX price hits the lower target level then the trader immediately loses.

- In the adjacent screenshot the USD-CHF price is 0.91359 with target levels of 0.9137880 and 0.9133919.

- The term of the bet is 5 minutes (top left) of which there are 2 min 36 seconds (top right) remaining.

- The gap between the two target levels and the FX price are equal. This means that there remains a 50:50 chance of winning or losing.

- The target levels are delineated in green and red to show the strategy immediately wins or is KO'd, on touching the green or red line respectively.

- If the FX price hits neither target levels the trader is returned the stake less a small percentage of the stake.

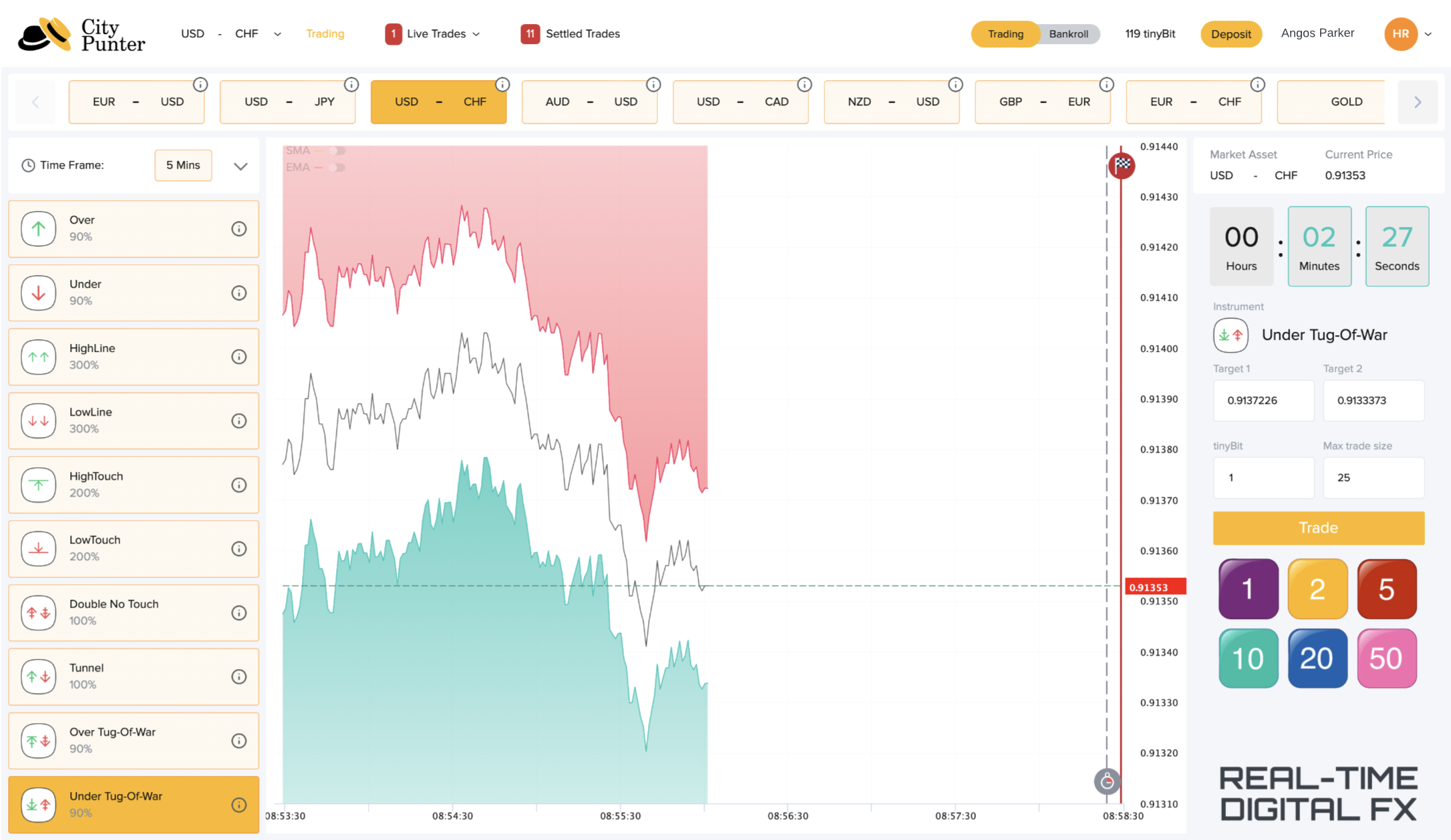

Under Tug-of-War

- Under Tug-of-War is the opposite of the Over Tug-of-War